Pop quiz question:

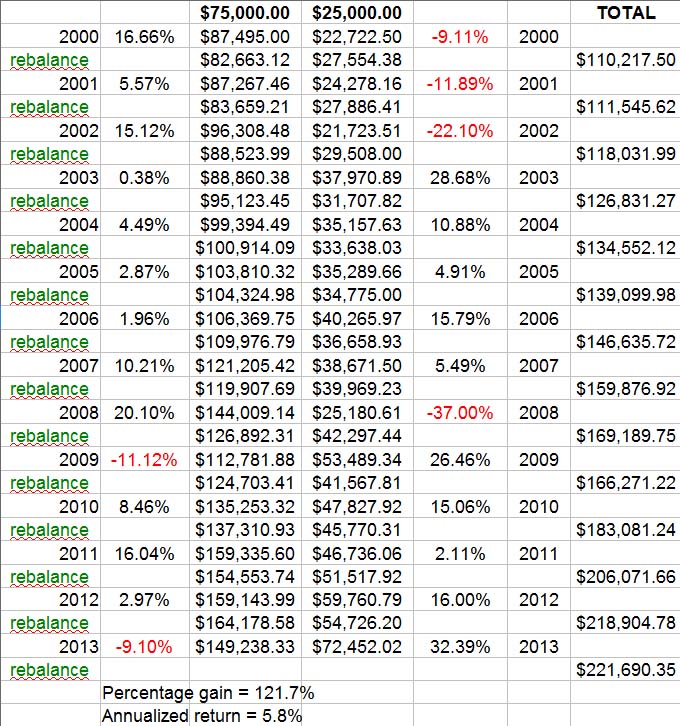

From January 1, 2000 until January 1, 2013 the S&P 500 price return index only gained 1.73%. That's not 1.73% per year but 1.73% for that entire 13 year period! So how much did $100,000 (with 25% invested in an S&P 500 index fund and 75% in 10-year Treasury bonds) grow to by the end of 2012 if dividends and interest were reinvested, and a simple annual rebalancing strategy was implemented once per year to maintain the 75/25 ratio?

A) $110,316 --- B) $148,084 --- C) $176,459 --- D) $218,904

ANSWER: $218,904

This was a little bit of a trick question because the S&P 500 price return index does not include dividends. Websites like Yahoo finance do not provide total return charts that factor in dividends, nor do they factor in compounded growth if you were to reinvest dividends. Additionally rebalancing typically increases returns.

Many investors have been falsely led to believe by commission-based "advisers" that the open market is risky because stocks alone performed poorly during the 2000's. They use this false premise as their platform to sell annuities and other oddball products. The whole time they blatantly ignore diversification into bonds. Bonds are slow, consistent and serve as a "stock shock absorber".

They also ignore the positive cumulative effects of dividend / interest reinvestment and compounded returns over time.

According to Vanguard rebalancing adds up to .35% annually. Over time this can further compound.

So during the "lost decade" from 2000 - 2010, if you were an ultra-conservative investor who was appropriatly diversified into not just stocks but bonds, then you weathered the stock market storm just fine! By the end of 2012 (after 13 years) your actual annualized return on investment was a respectable 6.2%. Treasuries lagged in 2013 and so this brought the 14 year annualized ROI down to 5.8%.

In conclusion it is critical that investors study the historical returns of bonds and stocks before being tempted to invest in alternative products being pushed on them by commission-based "advisers".

NOTE: You can perform your own return on investment calculations at this website.

GO BACK to main page

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.