The Pros and Cons of Annuities

(previous) PAGE 2 of 9 (next)

1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - FAQ - Top Annuity Lies

Index Annuities - Immediate Annuities

Life Insurance

Another blatant salesman lie / shell game:

"You don't pay me any commission"

When calculating how much income to pay you, the insurance company will factor in all of their costs including mortality expenses, underwriting costs, and administrative expenses including their CPA's, lawyers, litigation costs, accountants, customer care reps, office space rent, website costs, political lobbying costs, etc, etc. An insurance company is also a for profit company. They need to make money off of the contract too. Last but certainly not least they factor in the 5 to 10% commission that they pay the sales agent who manages to dupe you into investing in the annuity. When it's all said and done you will get less... a LOT less!

When calculating how much income to pay you, the insurance company will factor in all of their costs including mortality expenses, underwriting costs, and administrative expenses including their CPA's, lawyers, litigation costs, accountants, customer care reps, office space rent, website costs, political lobbying costs, etc, etc. An insurance company is also a for profit company. They need to make money off of the contract too. Last but certainly not least they factor in the 5 to 10% commission that they pay the sales agent who manages to dupe you into investing in the annuity. When it's all said and done you will get less... a LOT less!

With an index annuity, the insurance company will simple lower things like your participation rate and participation caps in order to compensate for all of their many costs including your sales agent's lavish commission.

Most illegal annuity sales go undetected

Unfortunately it is not illegal for an adviser to sell an annuity merely because an annuity is a very poor choice and there are much better alternatives. But one thing that is illegal is "unsuitable" annuity sales. However investors need to first beware that 1) the legal "suitability standard" is very low and 2) most unsuitable annuity sales that do occur go undetected.

There are many situations that make an annuity sale unsuitable and it varies by jurisdiction. Some of the more common situations that are unsuitable include 1) An agent recommends that the consumer put most of their liquid assets in an annuity or annuities, 2) The consumer will incur substantial tax penalties or early surrender fees from a replaced product, 3) The consumer will be subject to a new lengthy surrender period, 4) An agent recommends replacing an annuity with one that is essentially the same or has similar benefits, 5) The annuity surrender period is longer than the life expectancy of the consumer. Don't ever assume that the insurance company, FINRA or the SEC will catch and prevent an unsuitable annuity sale.

It is illegal for an insurance salesman (who is not a broker or RIA) to recommended that you cash out some or all of your stocks, bonds, or mutual funds in order to purchase an annuity

It is not against the law for an insurance agent to just sell you an annuity. It is the recommendation that you sell off securities that is illegal. Only Broker / Dealers and Registered Investment Advisers may give such advice to sell securities. An insurance agent may not give any advice to buy, sell or hold a stock, bond, mutual fund or ETF under any circumstances. CLICK HERE if you need to read more on this topic. Contact the Securities and Exchange Commission if this has happened to you. You may also wish to contact an attorney.

Young people especially should never invest in annuities

Young people especially should never invest in annuities

When you’re young you are accumulating wealth for retirement -- Not living off of your savings. Therefore guaranteed income and hedging against longevity risks are not of major concern. Furthermore, one of the most important aspects of retirement is time. If you squander it (with consistently inferior and expensive financial products like annuities) when you are young, then this has a great impact after 20 or 30 or more years! So it is irresponsible enough for an "adviser" to recommend that people in their 40's lock their money up in an annuity prison; It is certifiably insane for an "adviser" to recommend that someone in their 20's or 30's lock their money up in an annuity for decades. Fear of loss of principal should not be a concern for young investors. T. Rowe Price (which sells annuities) has stated that the average investor needs to remain invested in a variable annuity for 10 to 20 years in order to justify the high fees. Over long periods of time (example 20 years) even the stock market alone (with no bond diversification) has NEVER been negative. Therefore a variable annuity guarantee against loss of principal has had NO value throughout history. In reality you just cost yourself a lot of money in fees that compounded year after year. After 20 or more years getting your money out will take many years if you wish to avoid excessive ordinary income taxes.

And there is absolutely no way to predict whether you might need that money before age 59 1/2. Car accident? Medical bills? Spouse's or children's medical bills? Children education? Job loss? Lawsuit? Marriage problems? Divorce? Babies? Upgrade to a better home? Recession? Family member needs financial help? Athletes lose tens of millions -- Every day people can certainly lose much less just as easily. It has been said that statistically 25% of annuity holders withdraw money early and they pay dearly! I suspect that this figure may have risen since the 2008 stock market crash. A large part of insurance company business is actually pocketing surrender penalties from investors who couldn't stay the course! Certainly even more people probably want to withdraw money early but don't because of the massive penalties. If you're even as old as 49, in your right mind do you really want to unnecessarily put your money behind bars for at least 10 years when you don't need to? No way! And don't forget that withdrawals must be tightly controlled. If you take out a lot of money in once year you will be taxed to death!

The long-term effects of paying inherent high annuity fees and higher taxes will take a big bite out of a young investor's annuity investment. Remember that when someone buys an annuity this typically results in a wealth transfer of as much as 15% to 20% from the investor to the insurance companies and the sales agents. Starting at a young age virtually guarantees this wealth transfer to occur.

Annuities are not appropriate for wealthy people

Annuities are not appropriate for wealthy people

If you have a high net worth or very high income then the last thing you need is an annuity to insure a portion of your portfolio against "loss of principal", especially over the long-term. If you're rich and your diversified (bond / stock) portfolio was to somehow decline 25% in value in a few years time (which past history says this is not even realistic to begin with)... guess what? You're still rich! An annuity is something that you don't need to pay high fees for.

Also the effects of ordinary income taxation would be devastating to a wealthy person when taking annuity distributions. See the tax chart shown later in this article. Run for the hills from any "adviser" who suggests that you need an annuity. Report them to the securities and exchange commission to see if they may have violated securities laws.

Never use your home equity to invest in anything!

Some unscrupulous annuity pushers have actually convinced people to take out a loan against the equity of their home in order to invest in annuities. This is inappropriate advice to be getting from even non-fiduciary advisers who are only held to the lower "suitability standard" required of broker / dealers. Contact a securities attorney if this has happened to you!

Avoid incurring large capital gains taxes by selling off a bunch of stocks (or other investments) in order to invest in annuities

It may even be against the law for an annuity pusher to recommend that you sell off large amounts stocks (or other investments with large capital gains taxes to pay) in order to invest in anything, including an annuity. Contact a securities attorney if this has happened to you! It is very possible that your broker is trying to "churn" your account.

Never use after-tax money to invest

in an annuity before age 59 1/2

If you use after-tax money to invest in an annuity then you are suddenly subjecting that principal to a 10% Federal penalty as well as an additional state penalty (1% in California) if you were to want to withdraw it before age 59 1/2 that you would otherwise not have to pay with normal investments like ETF's. This is completely unacceptable. Sadly there are unscrupulous "advisers" who freely recommend that investors in their early 50's, 40's and even younger pour after-tax money into annuities. Also this does not mean that it's OK to use pre-tax money to invest in an annuity either!

Additionally you are subjecting any annuity gains to the higher ordinary income taxation rate.

Never put a large percentage of your liquid savings into illiquid investments

If you've already read the basic rules of investing then you know to avoid illiquid investments like annuities and actively managed mutual funds that have front end or back end loads, or otherwise force you to stay for a long time. "Liquid" on the other hand means money that you can get at immediately -- think stocks, stock and bond ETF's, checking account savings. Liquid savings does not include things like equity in real estate that you own. Yet we constantly hear shocking stories of investors who were duped by "advisers" into pouring 25%... 50%... or even 75% of their liquid savings into illiquid investments like annuities. In this day and age there is no reason to make the mistake of locking your money in prison. The only reason is that Mr. Annuity Salesman wants an even BIGGER commission. Illiquid investments pay big commissions!

Also never invest a large amount of money into an annuity or a smaller amount that is likely to grow into a larger amount at a later age. The effects of ordinary income taxation will crush you. See the tax chart shown later in this article.

What Mr. Annuity Salesman will NEVER tell you:

VANGUARD offers the lowest cost annuities by far

and has NO insurance company surrender charges.

You can switch to VANGAURD through a tax-free 1035 exchange.

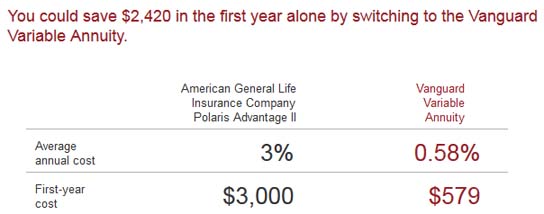

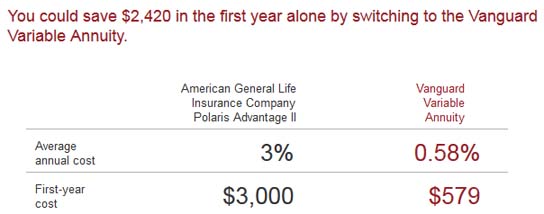

If you are stupid enough to put your money in an annuity then only invest in a non-retail annuity such as Vanguard annuities. Vanguard annuities have no insurance company surrender penalties or "contingent deferred sales charges" (CDC's), and their fees are drastically lower than the so-called "retail annuity" products that non-fiduciary salesmen push. Vanguard's fees are low because their annuities are sold directly to the public only. Vanguard does not pay commissions to any brokers, advisers, insurance agents or anyone else. That is why a non-fiduciary "adviser" will never recommend a Vanguard annuity even though Vanguard's annuities are vastly cheaper. The fact that your so-called "adviser" is recommending that you buy an annuity is proof that you are being fleeced. The fact that he is recommending anything other than Vanguard is further proof positive that they have put their own monetary needs ahead of yours. This is what you get when you go to a non-fiduciary for personalized financial advice.

If you are stuck in an annuity now, the insurance company surrender period has expired, and you're under age 59 1/2 then speak to your tax accountant and consider switching to Vanguard (as discussed near the end of this article). Stop being gouged by your current annuity's high annual fees! CLICK HERE to calculate how much you will likely save in the first year alone. If in the last 10 years (during which Vanguard annuities have been in existence) you were sold a "retail annuity" rather than a Vanguard annuity then it is almost a certainty that you were fleeced. At right is a typical fee comparison example using an example of a Sun America annuity.

If you are stuck in an annuity now, the insurance company surrender period has expired, and you're under age 59 1/2 then speak to your tax accountant and consider switching to Vanguard (as discussed near the end of this article). Stop being gouged by your current annuity's high annual fees! CLICK HERE to calculate how much you will likely save in the first year alone. If in the last 10 years (during which Vanguard annuities have been in existence) you were sold a "retail annuity" rather than a Vanguard annuity then it is almost a certainty that you were fleeced. At right is a typical fee comparison example using an example of a Sun America annuity.

According to Morningstar, as of December 2015, the Vanguard Variable Annuity has an average expense ratio of 0.54%, versus the annuity industry average of 2.24%. That extra 1.7% will cost you 15.7% after 10 years, 29% after 20 years, and 40% after 30 years.

As low cost as Vanguard's variable annuity sub funds are, don't lose sight of the fact that their sub-funds are still about 0.45% more expensive than equivalent liquid index funds that you would invest in outside of an annuity. And while most annuities charge about 1.4% per year in separate fees, Vanguard only charges 0.3% (0.10 administration fee + 0.19% expense risk fee). With ETF's you would pay NO separate account fees! Again, as low cost as Vanguard annuities are, you still don't want to lock your money up in any annuity. All of the other unavoidable negative things about annuities such as nasty tax penalties, higher ordinary income taxation, and lack of stepped up tax basis still apply. Even with the bare minimum of annuity options you will be paying a total of about 0.73% more per year with Vanguard than with a portfolio of plain old index fund ETF's (outside of an annuity). Compounded over just 10 years that amounts to perhaps about 10% in lost gains! If your bonds and stocks gained nothing after 10 years you would be losing 7.5% due to Vanguard's "low" fees or 11.5% after 15 years. Vanguard is only a smart option if you are already stuck in some other annuity that Mr Insurance Agent or Mr. Broker sold you. Speak to your tax accountant first.

Why fees matter

According to Morningstar, Inc., as of December 2012 Vanguard's Variable Annuity has an average expense ratio of 0.58%, versus the annuity industry average of 2.28%. That's a difference of 1.7% per year in added fees. You can use this website to calculate how much this compounds over perhaps 10, 20 or even 30 years. Below I compared hypothetical Vanguard annuity returns of 6% versus 4.352% for the average annuity when investing $100,000.

After 10 years the average annuity would be worth $152,350.22

After 10 years Vaguard's annuity would be worth $179,084.77 -- You saved $26,734.55

After 10 years the ETF portfolio would be worth $189,483.78 -- You saved $37,133.56 -- While the annuity grew tax deferred, with the ETFs you likely paid lower taxes (as exposed by Wealth Manager's article "Photo Finish").

After 20 years the average annuity would be worth $232,105.89

After 20 years Vaguard's annuity would be worth $320,713.55 -- You saved $88,607.66

After 20 years the ETF portfolio would be worth $359,041.04 -- You saved $126,935.15 --While the annuity grew tax deferred, with the ETFs you likely paid lower taxes (as exposed by Wealth Manager's article "Photo Finish").

After 30 years the average annuity would be worth $353,613.84

After 30 years Vaguard's annuity would be worth $574,349.12 -- You saved $220,735.28

After 30 years the ETF portfolio would be worth $680,324.55 -- You saved $326,710.71 --While the annuity grew tax deferred, with the ETFs you likely paid lower taxes (as exposed by Wealth Manager's article "Photo Finish").

Conclusion: Don't invest in any annuity. If you are already stuck in an annuity then talk to a fee-only fiduciary adviser about switching to Vanguard.

Annuities make the top 10 list of scams / investor alerts

Top 10 List of Scams - Retail variable annuities are often found in the list of scams compiled by regulators and protection organizations because the agents who sell annuities usually lie and distort the truth. Index annuities are often targeted in investor alert articles for the same reasons. The solution is to avoid these investments and instead consult with a certified financial planner on an hourly and paid basis

Beware of coming annuity name changes

Beware of coming annuity name changes

As disgruntled investors speak out, the word "annuity" has become a nasty word. Insurance companies are well aware of this branding problem. So be on the alert for new names for annuities such as QLAC (or qualified longevity annuity contract), "longevity insurance", "private pension", "lifetime income", "lifetime paycheck", universal life insurance, variable life insurance, whole life insurance or any other conceivable name that might not have the word "annuity". But when they put lipstick on this annuity "pig" you should know that any investment sold by an insurance company is still just a pig! If it's a product offered by an insurance company then you should know just to avoid it. If it's not publicly traded on the NYSE or NASDAQ stock exchanges then absolutely void it. Avoid any investment that is long-term, has early exit penalties and requires that you sign a "contract". Normal investments don't require you to sign any a contract.

It is very common that companies that sell annuities run radio spots that never even mention what mysterious financial product they are actually selling. Just references to the usual buzz words that are synonymous with annuities or other expensive insurance products like whole life insurance, "Never outlive your money", "Stop worrying about market fluctuations", "no risk to your original principal", etc.

Beware of brokers who may try to justify their sky high annuity sales commissions

Broker / advisers may shamelessly argue that the high 5 to 14% annuity sales commission that they are paid somehow isn't excessive when considering that an annuity is a one-time long-term investment. This is nonsense because non-commission based investments like ETF's (like SPY and BND) are not only historically superior performing but vastly cheaper than annuities. Putting this aside, it is a fact that any commission equals a conflict of interest. Once an insurance broker sells you that annuity he doesn't have to do a thing AND he will typically earn a 1/4% "trailer fee" for each year that you remain invested in the annuity. Not bad for selling you a crap investment and then doing absolutely nothing. Furthermore your broker's ultimate goal is to get you to switch annuities after a few years. He may intentionally sell you one annuity while knowing full well that there's another supposed "better" annuity that he will try to sell you down the line. Or he may be lying in wait for an excuse to develope. Perhaps the insurance company's safety rating gets lowered by Fitch, Moody's or A. M. Best. Rarely is this cause to switch annuities but if you fall for it then he'll earn yet another lavish commission. The problem is compounded if your broker originally persuaded you to put all of your money (or a large chuck) into just one annuity or annuities all offered by the same insurance company. Instead of paying a surrender fee on a fractional part of your savings, you're paying to surrender all of it! That's when you know for sure that your broker has played you like a fiddle.

Brokers also love to make the faulty argument that they aren't that expensive when compared to the fees that you would incur if you were to work with an asset manager (on a yearly fee basis). I would never advocate working with a full time asset manager. That is akin throwing away money too. If you insist on having someone hold your hand while you invest then you should only meet with a fee-only fiduciary registered investment adviser for a one-time consultation to help you come up with a "game plan" and build a simple portfolio. Better yet do it yourself! It's very easy.

(previous) PAGE 2 of 9 (next)

1 - 2 - 3 - 4 - 5 - 6 - 7 - 8 - 9 - FAQ - Top Annuity Lies

OR MOVE ON TO THE NEXT ARTICLE: Oddball investments

Disclaimer and Waiver - Nothing on this consumer advocate website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy, hold or sell, or as an endorsement, of any company, security, fund, product or other offering. This website, its owners, affiliates, agents and / or contributors are not financial or investment advisors or broker / dealers and assume no liability whatsoever by your reliance on the information contained herein. The information should not be relied upon for purposes of transacting securities, assets, financial products or other investments. Your use of the information contained herein is at your own risk. The content is provided 'as is' and without warranties, either expressed or implied. This site does not promise or guarantee any income or particular result from your use of the information contained herein. It is your responsibility to evaluate any information, opinion, advice or other content contained. Always hire and consult with a professional regarding the evaluation of any specific information, opinion, or other content.

When calculating how much income to pay you, the insurance company will factor in all of their costs including mortality expenses, underwriting costs, and administrative expenses including their CPA's, lawyers, litigation costs, accountants, customer care reps, office space rent, website costs, political lobbying costs, etc, etc. An insurance company is also a for profit company. They need to make money off of the contract too. Last but certainly not least they factor in the 5 to 10% commission that they pay the sales agent who manages to dupe you into investing in the annuity. When it's all said and done you will get less... a LOT less!

When calculating how much income to pay you, the insurance company will factor in all of their costs including mortality expenses, underwriting costs, and administrative expenses including their CPA's, lawyers, litigation costs, accountants, customer care reps, office space rent, website costs, political lobbying costs, etc, etc. An insurance company is also a for profit company. They need to make money off of the contract too. Last but certainly not least they factor in the 5 to 10% commission that they pay the sales agent who manages to dupe you into investing in the annuity. When it's all said and done you will get less... a LOT less! Young people especially should never invest in annuities

Young people especially should never invest in annuities Annuities are not appropriate for wealthy people

Annuities are not appropriate for wealthy people

If you are stuck in an annuity now, the insurance company surrender period has expired, and you're under age 59 1/2 then speak to your tax accountant and consider switching to Vanguard (as discussed near the end of this article). Stop being gouged by your current annuity's high annual fees!

If you are stuck in an annuity now, the insurance company surrender period has expired, and you're under age 59 1/2 then speak to your tax accountant and consider switching to Vanguard (as discussed near the end of this article). Stop being gouged by your current annuity's high annual fees!